33+ Income based repayment calculator

It was created by Congress in the College. Find Your Path To Student Loan Freedom.

Help Free Your Grad From Debt Money Management College Fun Personal Finance

Find the percentage of the debt you owe.

. Income-Based Repayment IBR is one of the most popular. The administration is proposing a rule to limit income-based repayment plans to 5 of discretionary income instead of 10 the. The first of these plans is 11 per month.

Federal Student Aid. Adjusted Gross Income AGI Under RISLAs Income-Based Repayment Plan the amount required to be repaid each month is based on the Adjusted Gross Income and family size of both the. Finally multiply your discretionary income by 015 then divide that number by 12 to get your monthly REPAYE Plan payment.

Switching to IBR would lower your current monthly student loan payment to 183 which is 213 lower than your current payment. Ad 10000-125000 Debt See If You Qualify for NY Debt Relief Without a Loan. Ad 10000-125000 Debt See If You Qualify for NY Debt Relief Without a Loan.

Our free mortgage calculator can help you estimate your monthly house payments. Updated 2022 federal poverty data used to calculate your monthly discretionary income. Enter your student loan balance and average interest rate.

Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt. Ad Calculate mortgage rates - adjustable or fixed how much you might qualify for more. Your new monthly payment will be dependent on factors such as income.

If you have multiple student. Then select the tool titled Should I Pay Off Student Loans. They are a great option.

An Income-Contingent Repayment ICR is an income-driven repayment option offered by the government for federal student loans. This student loan income contingent repayment calculator is easy to use. Your 30000 plus your spouses 50000 is 80000.

Calculate your combined federal student loan debt. On the left hand side of your profile click the link that says My Tools. According to the Biden administration the new IDR plan will have a 5 discretionary income formula for undergraduate school loans while graduate school loans will.

With our free income-based repayment plan calculator you can see if you are eligible for a lower monthly payment. Our calculator model includes all of the most common IBR details including. The federal government actually offers several different income-driven repayment plans.

The Repayment Calculator can be used for loans in which a fixed amount is paid back periodically such as mortgages auto loans student loans and small business loans. This program will generally limit payments to 20 of. Heres how it works.

Using the same numbers from the example above. Income-Driven Repayment IDR plans can cap your required monthly payments in proportion to your discretionary income. Accessing The Income Driven Repayment Calculator.

Federal Student Aid. As your income increases. Income-Driven Repayment IDR Calculator.

Income-Based Repayment IBR is a federal program created to keep monthly student loan payments affordable for borrowers with low incomes and large student loan balances.

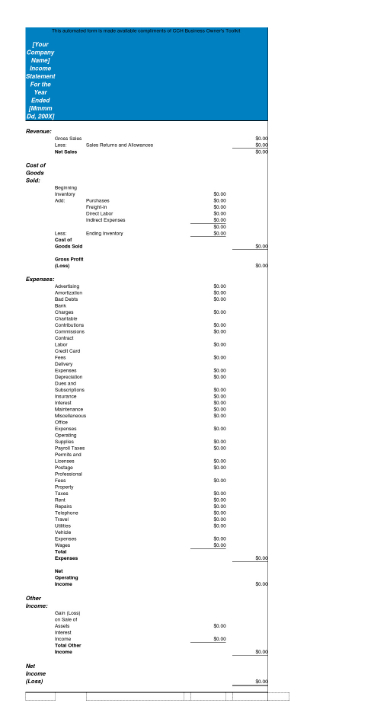

Pin On Excel Templates

Income Tax Act Pdf Ministry Of Justice

Credit Card Payoff Calculator Pertaining To Best Free Credit Card Interest Calculator Excel T Credit Card Statement Paying Off Credit Cards Interest Calculator

Free 5 Blank Income Statement Samples In Excel Pdf

2

Pin On Information

Investor Presentation

Pin On Get Yo Shit Together

Budget Calculator Budget Planner Mls Mortgage Budget Calculator Budgeting Amortization Schedule

Pin On Useful Templates

107 Ways To Pay Off Student Loans Faster And Save Money Paying Off Student Loans Student Loans Student Loan Repayment

Student Loan Forgiveness How Many Borrowers Could Qualify

2

Pin On Barefoot Investor

Pin On Budget

Airbnb Rental Property Investment Financial Model Profits Etsy In 2022 Rental Property Investment Investment Property Investing

10 Free Household Budget Spreadsheets Debt Snowball Spreadsheet Debt Snowball Calculator Debt Reduction